Table of Contents

ToggleTax Exemption for Solar Panel Year 2024-25

Tax Exemption for Solar Panel Year 2024-25: Pakistan Sets Notable Push – Tax Incentives for Solar Panels Starting Amid the budget session for the financial year 2024-25, for the first time in history, the Government Government of Pakistan has introduced major tax concessions implied to boost the solar industry.

The Finance Minister Muhammad Aurangzeb briefed the country about the measures to encourage solar production and selection in Pakistan.

The government of Shahbaz Sharif formulated duty exceptions on the import of key components such as plants, machinery, raw materials, and parts used in the making of solar panels, inverters, and batteries are planning to lower generation costs and bring down the overheads so that solar technology gets to be cheaper and more widely available over the country.

پاکستان کے بجٹ 2024-25 میں مقامی شمسی صنعت کو متحرک کرنے، اخراج کو کم کرنے اور زرمبادلہ کے ذخائر کو بچانے کے لیے ٹیکس مراعات متعارف کرائی گئی ہیں۔ یہ اقدامات مکمل سولر پینلز، مشینری، خام مال اور شمسی توانائی سے متعلق اجزاء کی درآمد کا احاطہ کرتے ہیں۔ نئے ٹیکس ریلیف اقدامات کا مقصد انورٹرز پر مالی بوجھ کو کم کرنا ہے، جس سے شمسی توانائی کو مزید قابل رسائی بنانا ہے۔ چینی سرمایہ کاروں نے مقامی مینوفیکچرنگ کو فروغ دینے کے لیے مکمل طور پر اسمبلڈ سولر پینلز پر درآمدی ڈیوٹی عائد کرنے کی تجویز دی ہے۔ حکومت موجودہ نیٹ میٹرنگ پالیسی کو برقرار رکھے گی، جس سے سولر پاور جنریٹرز کو اضافی بجلی گرڈ کو واپس فروخت کرنے کی اجازت دی جائے گی۔ یہ اقدامات سرسبز مستقبل کے لیے پاکستان کے عزم کی نمائندگی کرتے ہیں۔

Tax Incentives for Solar Panels

Further, the budget focuses on increasing household energy production (including atomic energy) and clean energy consumption. By removing charges from local energy providers to decrease imports of energy solutions that strain Pakistan’s remote exchange savings and decrease its financial sensitivity.

Secondly, the assessment concessions are too connected to aquaculture, which is present-day farming supporting food security.

The income show sets a mammoth objective to assess income of around Rs. 13 trillion (US$46.66) while connecting its future to the thought of maintainable improvement and green energy.

Industry insiders are embracing these financial policies based on the desire for both development labor and financial development in the renewable energy industry. Mustafa Amjad, Program Director of Renewable First, says: ‘Job creation and financial stimulus.

It is expected that these incentives will help reduce the cost of solar panels and make renewable energy systems more financially viable. Other sustainability activities empower Pakistan to develop as a role model for natural stewardship in the region.

Reduction in Solar Energy Costs

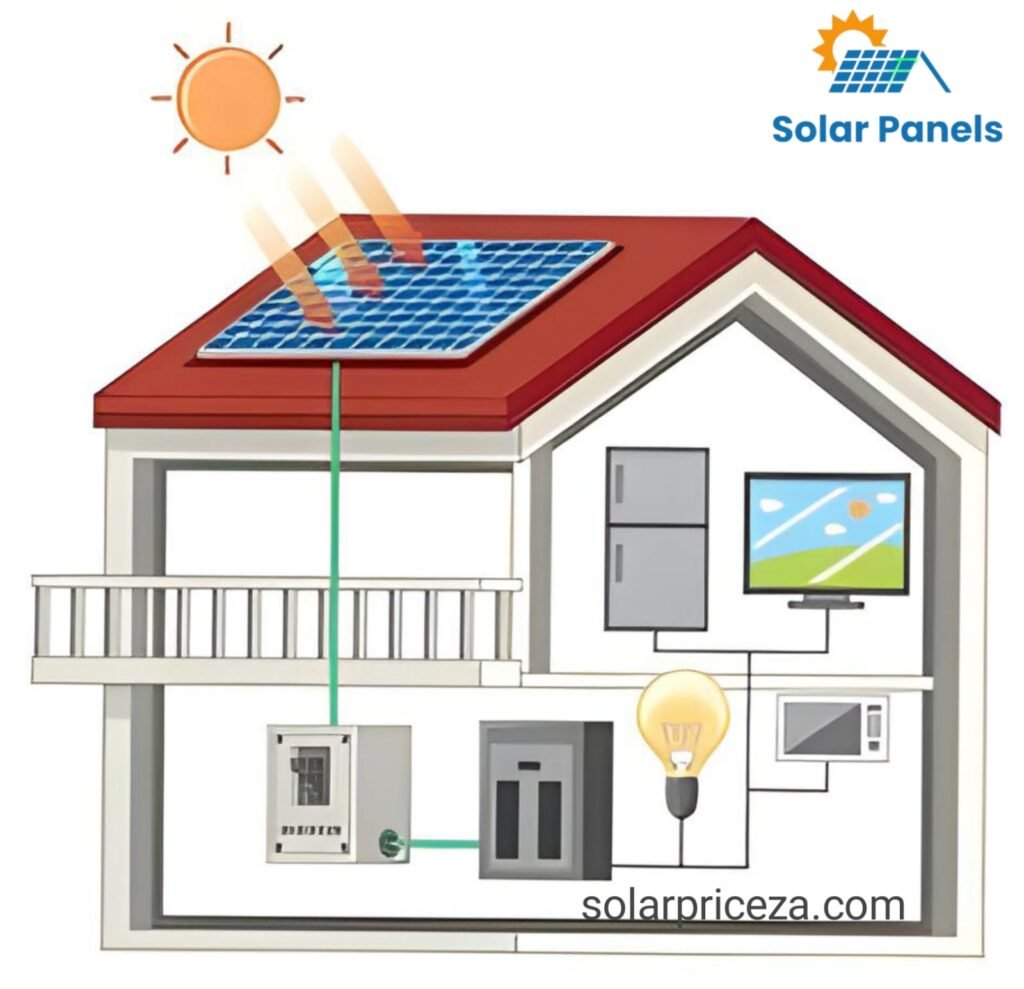

The later charge motivating forces given by the Pakistani government on the consequence of crude materials. Include the exception of duties on the basic components of solar energy systems. Which will enormously offer assistance in decreasing the fetching of solar installations all over Pakistan.

This is because manufacturing has taken a toll on solar panels will come down after the government scheme offers. The exclusion of import duties on those materials that are basic in creating sun-based panels.

This decrease in solar framework cost will help in the solarisation of provincial ranges and empower the usage of feasible energy in the country.

The promotion of solar energy ensures the sustainability goals of Pakistan and convenient clever utilization. Avoids carbon emissions from worldwide energy consumption design, and influences the natural balance.

Solar energy is considered green energy, which offers an excellent alternative to existing coal and oil energy sources. For generating power and is also a part of the global change for sustainability.

Pakistan’s Solar Power

By differentiating Pakistan’s energy mix, with greater dependence on solar power. Long-term energy security is progressed by decreasing dependence on outside imports of fossil power. The strength of the Pakistani energy system is stronger to more extensive financial shifts globally.

Finally, it can be concluded concerning the assessed motivations announced in the 2024-25 Budget that these motivations are the most important steps. For both making energy available as well as more reasonable and maintainable. And for the financial improvement of Pakistan, through renewable energy arrangements.

Pakistan will certainly benefit from lower energy costs, improved natural well-being, and more economic and financial growth.

Conclusion:

Understanding solar panel access in Pakistan is basic for anybody looking to invest in solar energy. Whereas the assessed structure can be complex, the benefits of solar energy frequently exceed the starting costs. With the right information and planning. You can make educated choices that adjust to your financial objectives and contribute to a greener future. As the government proceeds to advance renewable energy. Remaining overhauled on assessing policies and motivating forces will be significant for maximizing your investment in solar power.

FAQ’s:

According to the Power Division, the nation does not yet impose a fixed tax on solar energy.

The Shahbaz Sharif government reduced import duties on the raw materials used in the production of solar energy for the fiscal year 2024–2025 budget allocation. Local production of solar panels, inverters, and batteries is expected to result in lower costs.

ISLAMABAD: According to the Federal Board of Revenue (FBR), the sales tax exemption was formerly granted for the import and supply of solar panels. Accessories were removed and then reinstated solely for photovoltaic cells.